Japan Strategy: Ten Cheers and Fears of 2024

Tourism – too much of a good thing.

A look ahead to what may impact investors in Japan in the coming year.

Stronger yen and higher interest rates, leads to corporate profit expansion, supports pay rises and domestic consumption.

A crisis in domestic and inbound tourism develops with multiple issues facing Japan, trouble is brewing from Tokyo to Kyoto.

Stocks continue to rally and foreigners remain attracted to Japanese assets. Property market does not collapse as rates rise, investment in JGBs return.

A tough start to 2024.

The Sea of Japan Earthquake on New Year’s Day followed by the Haneda Airport collision on the 2nd have somewhat marred the start of the year.

The earthquake recovery will be a long process and although natural disasters are difficult things to put a positive spin on, economically there can be some benefits longer-term with the rebuild, but for at least the next month the celebrations and gift giving that normally come in January will be toned down.

However, here is my humble view of how the New Year is likely to shape up and what we should be looking out for – the “Ten Cheers and Fears for 2024”.

I have arranged them in order of what I think is the most important to consider, the first three to look at now; Bank of Japan and Ministry of Finance, Tourism and consumption and foreign investor activity, the rest may impact a little later in the year.

Topics include:

Stronger yen and higher interest rates

A tourism crisis, inbound and domestic

Corporate profit expansion, 17-20% rally in equities

Consumption; negatives and positives

Defence and Japan’s alliances in Europe and with its Asian neighbours.

…and some other thoughts for food, water, climate, technology, and space.

The Ten Cheers and Fears.

1. Corridors of Power - Bank of Japan (BoJ) and Ministry of Finance (MoF), what will we see from controllers of finance in 2024.

The long-awaited normalization of interest rates with the removal of the negative 10bps overnight rate is inevitable. I believe this will happen soon, and the yen will strengthen further. For what it is worth, I have 130-lows against the USD in mind within the next few months. The BoJ will be able to back off further in the bond markets in the knowledge that domestic institutions will buy, favouring domestic bonds again as liquidity returns. I am expecting further development of the convertible bond market, a mainstay for corporate financing in the 80's and early 90's.

However, the Sea of Japan Earthquake may cause the BoJ to hesitate in January as consumption drops fast with the national mood. The cost of assistance and reconstruction may draw on taxes in 2024 but the earthquake was centred on a lightly populated and not densely industrialised part of Japan and the insurance industry is not expecting any significant strain due to claims. The tax payer may get of lightly with this one.

Tax revenues continue at a record high and could break new records again in 2024 and the MoF may be able to reduce bond issuance for the fourth year in a row as originally planned.

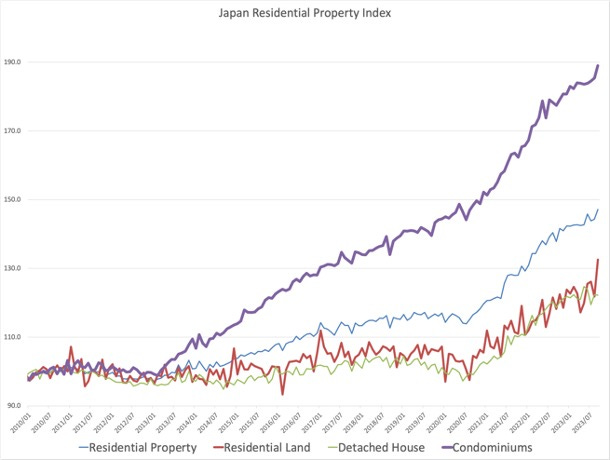

Higher interest rates will start conversations about Japan's property market correcting where inner-city condominiums have been on a tear since the start of Abenomics in 2012 (See Fig 1). Given rates are coming from such a low base, even if a 0.5% mortgage rate doubles the monthly repayment is still mainly principal. I do not see a scenario currently that would cause the property market to collapse and migration to cheaper and larger property outside the central cities may continue.

Fig 1. Japan Residential Property Index (2010 = 100)

Source: Ministry of Land, Infrastructure, Telecommunications and Tourism

2. Tourism and consumption - 2024 could be tough for this theme with multiple headwinds:

Trouble is on the horizon in the form of:

Concentrated over-tourism, echoes from Barcelona in 2017 and the anti-tourism protests. Residents in Tokyo, Osaka and Kyoto are fed up.

Bed-bug infestations from spring could be facing Japan's hoteliers and inn keepers as the weather warms up.

Stronger yen making a trip more expensive and potential problems for air passengers as war in the Middle-East could spread impacting fuel and routes.

Tax-Free Shopping becomes less attractive, a fraud spree on Japan's simple tax deduction for tourists with passports at the checkout will be a thing of the past.

A respected fortune teller in HK warned that 2024 would be bad for transport accidents and dangerous to visit to seismically active countries.

Mainland Chinese tourists may not be seen in great numbers roving the globe for economic reasons for some time, but the superstitious populations of greater China; Hong Kong, Taiwan and Singapore, may have another good reason not to visit in the year of the dragon - astrology.

The Sea of Japan Earthquake and an unthinkable collision at Haneda Airport was followed by a knife attack on Tokyo's Yamanote and fires in restaurants in popular tourist areas of Shinjuku and Kita-Kyushu. Western visitors are more likely to be put off by a war against bedbugs that plagued Paris and Seoul last year, and may be comfortably bedded down in the nooks and crannies in Japan's hotels and inns.

Fig 2. Too much of a good thing – Kyoto is overrun with tourists

Source: Kyoto December 2023

3. Foreign investors take a new look at Japan, renewed interest from the big players from the 1980's.

The rally in Japanese equities on Q2 2023 was driven by five factors:

TSE Reforms. In March the Tokyo Stock Exchange (JPX) threatened delisting companies unless there were quantifiable efforts seen to improve valuations.

Investment in China by non-Asian investors became scarce as Scandinavian pension money got out, followed by European and US investors who started to favour other markets, particularly India and Japan.

Corporate profits, tax revenues and pay increases hit record highs, interest rates remained at record lows.

Warren Buffet's visit to Japan in Q2, only the second ever in his life, had a profound positive effect on investor and broker sentiment on Japan

Corporate Actions; buybacks, M&A. The efforts led by Prime Minister Abe on attitudes towards shareholders and expanding overseas is paying off.

Whilst investing in China and Emerging Asia remains a challenge, alternative markets in the region, particularly Japan and India, will likely see continued interest. I am expecting the Nikkei 225 to breakthrough ¥37,000 before May and potentially with Japanese domestic investors reengaged through the NISA saving and investment wrappers, a push higher mid-year.

The old high of close to ¥39,000 will likely be approached this year with a rally of some 20-25% in equities again for the same reasons the market performed in 2023; earnings growth, corporate investment demand, consumer demand, GDP growth surprising to the upside. A re-rating of the market valuations may take place; EPS growth, RoE, P/B as the TSE continues to exert pressure.

Buying of Japanese equities has so far been concentrated in the Topix Core 30, or the Nikkei 225 through ETFs, as the pool of Japanese equity expertise has been drained over the past 30 years. A build out of research capabilities in the first half of 2024 and a broadening knowledge base is likely, which will in turn lead to a wider number of stocks coming under foreign selection, in which case the names in the Topix Core 30 may underperform their lesser known peers in the second half.

Fig 3. A big year for the Topix Core 30

Source: Investor.com

4. Geopolitics, security, and defence spending.

The trend of increased spending on defence is undeniably set now and with war in Europe and in the Middle East, neither of which were well predicted, the uncertainly of what could happen in Asia is on the minds of everyone living there.

Being the most heavily armed corner of the planet, the potential for an accidental conflict is more likely in 2024 in the region than ever before and this should be a major concern.

Japan will continue to get closer to its neighbours in the region and allies in Europe. We will find out more this year about the potential to supply equipment to Southeast Asia for the military and pseudo military applications, such as the coastguard and land-based defence, search and rescue.

India will feature heavily, both as a buyer of armaments and a supplier of technology to Japan - especially drones - followed by the Philippines and possibly Australia. I expect an invitation to be extended for Japan to get closer or join AUKUS.

Questions are likely to be asked again should Japan have its own nuclear capabilities which will be tough public discussion to conduct, but was raised as a possibility in defence strategy conversations during the Trump administration against the backdrop of one day seeing the Americans move out of Japan and South Korea retreating to the Marianas.

At an equipment level, Japan's manufacturing of armaments will be stepped up. Much of NATO's ammo has been depleted supplying Ukraine, and whatever maybe needed in the Middle East will draw on stocks more. There could be opportunities for Japan now that legislation has passed allowing the exports of lethal weapons and associated ammunition.

We will see new companies being involved in armament manufacturing as well as the old, trusted suppliers doing more, a greater emphasis on autonomous and remote-controlled equipment, a push on drones as the Japanese Ministry of Defence have seen from the Ukraine-Russian conflict how effective they can be. This will be a boost for the technology both onshore in Japan and with partners in India.

Fig 4. Drones downed by Mitsubishi Electric LASER

Source: DSEI 2023 Tokyo

5. Climate control - where Japan may play a key role globally dealing with water and food crises.

Water and food are the two areas where we are likely to see increased Japanese presence globally with technology and knowhow stemming from many years of experience in dealing with these two critical resources.

Worldwide demand for fresh water will not slow, irrespective of climate changes which is more likely make things worse. Japanese experience in water management stems many decades being the first developing nation to work out the connection between land subsistence and ground water extraction during the industrialization of Tokyo and Osaka into the 1940's. By 1945 there was a clear correlation between the two - the same issue faced by Jakarta today.

Japanese companies have developed technologies that cater for all stages of the water cycle, not just establishing a constant source of fresh water and this can be seen throughout the Middle East to Singapore where Japanese companies were key in developing its water independence from Malaysia offering osmosis membranes, desalination technologies, wastewater treatment and the handling of water though advanced pumping know-how.

Fresh food production is the other climate affected industry that should be worrying everyone in 2024, which through necessity Japanese companies have gained ground since the rice crop failure of 1993. As diets have changed in Japan and its agricultural industry has aged and declined, technology in farming has become key to securing domestically produced fresh food. Today, Japan's food production still only accounts for 38% of its needs and given the impact of deteriorating weather in the past few years culminating in extremely poor yields in northwest Japan and Hokkaido in 2023 pushing up prices, a greater focus will be put on technology employed on the ground, in the air and in space.

Fig 5. £10 a bunch of grapes – discount supermarket ‘OK! Store’ Dec 2023

Source: OK! Store, Tokyo

6. Energy - Japan remains quick with ideas but slow in implementation, but pressure is mounting from the international community.

Once again bestowed with the 'fossil award' on the side-lines of COP28, Japan's Prime Minister Kishida was keen to promote contributions to climate action by saying that no new coal fired power plants would be built without reduction in carbon emission, or in other words, fossil fuels were not going away but decarbonization would be a major directive for industry to counter the carbon problem. Japan's projected energy mix in 2030 is still 41% coal.

In Japan, decarbonization will mean the increased use of low-carbon fuel sources, for example the co-firing of coal with ammonia (or hydrogen) and the development of coal-firing with carbon capture, usage, and storage (CCUS) technology. Prime Minister Kishida also said that Japan would lead other Asian countries in the reduction of carbon emissions where it would be difficult, or impossible to meet the strict rules for decarbonization, and Japan with its financial and technological clout, would tailor solutions country-by-country.

However, all of this does not sit well with the international community which is increasing pressure on Japan to commit to decommission coal altogether. Mirroring the success in the UK, increased investment in offshore wind farms alongside a serious push on hydrogen power is highly likely, with further investment in carbon recycling, which is still at a very early stage.

Offshore windfarms in Japan are likely to lean towards floating platforms as unlike the UK, it has few shallow coastal waters to anchor turbines. To date Japan has been successful in developing the floating technology; electrics - substations and undersea cables - management and operation but continues to rely heavily on imported turbines.

Hydrogen power is visible daily in Japan's cities with hydrogen powered buses and cars, but large-scale adoption including power generation will rely on hydrogen production technology - particularly electrolysis - transportation and delivery systems. The number of companies involved in this will grow.

7. Artificial Intelligence (AI) versus Real Intelligence and how to play the AI theme in Japan.

Interest comes and goes in the digital world, the past 20 years we have been told how crypto-currency and blockchains would knock fiat currencies out of our wallets, be the end of money laundering and financial crimes. It hasn't as amply evidenced by multibillion dollar fraudsters and money launderers Sam Bankman-Fried (FTX) and Changpeng Zhao (Binance) doing time for rounding off one of the worst years for financial fraud.

Going into 2024, the Metaverse is sparsely inhabited and has recently turned down the dark alley of child abuse, NFTs are irrelevant - in my humble opinion.

However, some elements of Artificial Intelligence (AI) are certainly going to be sticky, and we may not even notice as they come into our lives driving portals and products that we interreact with. The bottom line though is as we move through technology fads, whether that stick around or not, the demand for processing power, data and the speed of its transmission continuously grows, and if anything, that accelerates with processor hungry AI.

Japan's location, political stability, and technological capabilities positions itself to benefit from rapid expansion of datacentres. This is likely to feature in tech talk throughout the year and the number of companies involved will expand encompassing power supply, telecommunications and data transfer, air-conditioning and novel cooling technologies, security, disaster prevention, server related hardware, monitoring systems and data centre management.

Fig 6. Chat GPT with the human touch, a chatty bot, or not. AI at CEATEC 2023

Source: CEATEC 2023, Tokyo

8. Politics. Aside from LDP troubles at home, a big year ahead globally in politics. Japan will care about Taiwan, Indonesia, US and UK.

The Japanese Government worries about international politics and being close to who is in charge as evidenced by the late Prime Minister get hurriedly on a plane to visit Donald Trump, then President-Elect, in November 2016.

Undoubtably there will be preparation for a second-coming of Trump, but before then, the Taiwanese election on 13th January will signal how the Taiwanese want to position themselves vis-a-vis China and is today being suggested by the press as a binary choice between war and peace with China. That impacts Japan.

Indonesia is up next with a general election on 14th February. The former communist state has been dominated by centre-right parties since 1965, but the rise of a leftist party focused on worker rights suggests a change is afoot. There were some concerted efforts two years ago by Japan to get closer to this resource rich country, with the Emperor and Empress travelling to Indonesia on their first state visit abroad. This gives us a clue on how important the Japanese Government views the relationship with Jakarta, especially with its periodic nationalistic tendences towards exports.

The US election in November is shaping up to be a Biden-Trump battle, having had experience with both, Japan will be carefully preparing for one or the other and how to deal with new potential upsets if Trump returns to the White House.

And finally in 2024 the UK will likely be up for a general election sometime from the summer but no later than 28th January 2025. With both Prime Minister Rishi Sunak and Prime Minister Fumio Kishida on a race to the bottom in 2023, this year could result in some further shake-ups as they both try to hold on to their jobs.

9. The new and improved Nippon Individual Savings Account (NISA) tax-incentivised savings and investment wrappers come into play, it could tempt Japan's sleeping investor base if they are confident in the stock market.

A flashback to 1986 - a nice rotund salesman from Sanyo Securities knocked on my front door and wanted to sell me NTT shares. The stock market was rallying, property market was strong, everyone in a job and being well paid and making good money on stock investments. His argument to me was that NTT shares were going to be very popular, the next best thing to owning property. I would have loved to buy shares, but they were only available to Japanese ownership, two further attempts by the persistent salesman and he finally understood I couldn't buy.

That experience serves as a reminder of how formidable retail stockbroking can be in Japan, there was nothing quite like it anywhere in the world. And it has been asleep at the wheel since the mid 1990s whilst the number of potential owners of shares has expanded significantly and through stock splits it is far more affordable: to invest in NTT in 1989 you needed about ¥1.49 million to buy the minimum lot, taking into account the stock splits along the way, now it costs less than ¥20,000.

In 2024, the stock market could pass previous highs, the property market is strong, everyone who wants a job has one and pay rises are coming though. And lot sizes are coming down rapidly. Throw into the mix strong results from Nomura for Q2 2023 announced last October and attributed to "a buoyant domestic stock market led to a surge in equity offerings and retail brokerage fees", source: Reuters, the new NISA may just tip the balance on engaging retail investors again and lead to an expansion of retail investor services, including sales and education.

Interesting sidenote; the Nikkei Newspaper is speculating that the Bank of Japan may have been net sellers of equities in 2023. If so, there is plenty more where that came from should the need arise to offer more incentives to individuals to buy.

10. Space. Japan soft lands a rover on the moon and plans to put boots down in the lunar soil alongside the Americans.

There are few angles for investors in Space in Japan, a couple of small companies and promises from start-ups from putting new satellites up to bringing old ones down may yield something in years to come, but it will take time.

More immediately, there could be a catalyst in the interest in space exploration amongst young budding astronauts globally when we return to the moon in the form of space related consumer goods from space toothpaste to orbital garb. For those that remember the buzz around the 1960's Apollo program and how space crazy us kids were, the new generation of space fans will be in for a treat in Japan with launch sites, space experiences and goods readily accessible on trips to Japan. This may spur a whole new angle for travel, opening new destinations and attractions for visitors to boldly go where no tourist has gone before.

Fig 7. Boldly going to Hokkaido

Source: SORA, Taiki Town Space Exchange Center.

All these topics will be covered in depth during 2024 by JAPANMACRO.com, be sure to subscribe to the research and request to join the mailing list.

IMPORTANT DISCLAIMER

JAPANMACRO articles are prepared for the purpose of providing general information only without taking account of any particular reader, or investor's objectives, financial situation or needs and does not amount to an investment recommendation. It is not investment research, it is personal opinion and should be treated as such.

Nothing published by JAPANMACRO constitutes professional advice, and is not, and must not be construed as investment advice, investment recommendations, investment research or a solicitation or offer to buy or sell any securities. I am not a stockbroker, I am a commentator. For investment advice, consult an investment advisor.

Please be aware that past performance is not necessarily indicative of future performance and the use of reports should not extend beyond being a source of opinion and debate.